Advancing International Competitivness through Regional Cooperation

Summary: Since its establishement in 2012 the Transylvanian Furniture Cluster (TFC) has rapidly evolved into one of most advanced cluster intiatives of the North-West Region in Romania, representing and addressing the interests and needs of the Northern Transylvanian Furniture Industry. The region has a long-standing tradition in furniture manufacturing and has grown into a major production and export location, with many local companies supplying international brands. TFC aims to further strengthen the sector’s role within international value chains, by supporting product innovations and advancing digital and sustainable production processes. Initially founded with support from the North-West Regional Development Agency, TFC emerged in a context of limited national support, resulting in early strategic orientation towards international cooperation and EU funding instruments. Driven by the need to strengthen competitivness, the cluster has continuously invested in high-quality infrastructure, such as the Center of Excellence in Furniture (CEF) and has become a regional hub for product development, prototyping, and knowledge exchange. Through its participation in numerous European projects, the GOLD labelled cluster has developed strong international linkages, enhanced its service portfolio, and contributed to regional policy dialogue. Its evolution demonstrates how early engagement in European cooperation, combined with strong regional cross-sectoral cooperation and a clear focus on cluster management excellence can accelerate long-term competitiveness.

North-West Region

The North-West Region, located in the northern part of Transylvania, is among Romania’s most competitive regions in terms of research and innovation infrastructures. It consists of six counties, Bihor, Bistrița-Năsăud, Cluj, Maramureș, Satu Mare, and Sălaj, encompassing a significant agricultural sector in the rural areas and dynamic urban centers, such as Cluj-Napoca. As the largest development region of Romania, the North-West Region stretches westward along the border of Hungary, borders Ukraine to the north and is delimeted by the Carpathian Mountains to the east. Due to its central location in Eastern Europe, the region is also home to a multiethnic population which includes a variety of cultural communities. With this diverse geographical and economic base, the North-West Region brings together a wide range of different industries, representing a dynamic development and research pole.

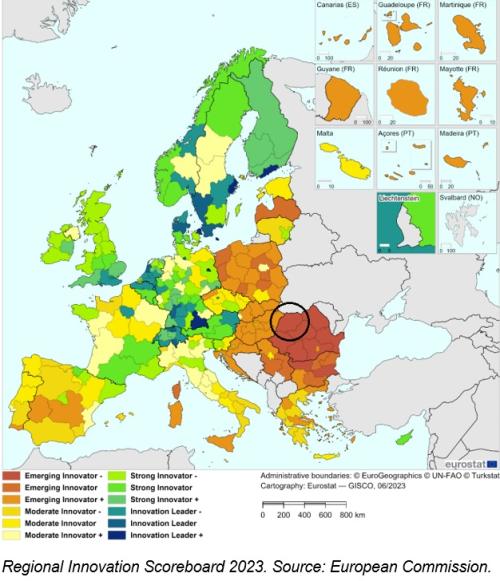

The EU Regional Innovation Scoreboard classifies the North-West Region as an emerging innovator. In general, Romania has the weakest innovation performance in the EU and the lowest level of gross expenditure in Research & Development (R&D). For the North-West Region, in particular, this is reflected in a below EU average R&D intensity. Despite this overall structural weaknesses in R&D investment, a significantly growing information and communications technology (ICT) sector in the North-West Region demonstrates promising innovation potential. Further R&D activities in the region focus on the areas of agricultural and food industry, bio- and nanotechnologies, and health.

With Cluj-Napoca as a center of activity, the region’s innovation ecosystem is shaped by a deepening cooperation between academia and industry. As key research actors Babeș-Bolyai University, the Technical University in Cluj-Napoca and the University of Medicine and Pharmaceutics actively engage in regional collaboration, by contributing their expertise and research capacity to the Transylvanian Digital Innovation Hub (TDIH). The TDIH was orchestrated by the Transylvanian IT Cluster with the objective to strengthen the regional innovation ecosystem and to promote the digital transformation process and innovation capacities of SMEs and the public sector. In addition to academic actors, it involves multiple regional cluster organisations, further reinforcing the strong presence of industrial clusters in the North-West Region. By bringing together diverse actors into a joint framework, the TDIH has evolved beyond a support structure, fostering cross-sectoral cooperation and knowledge exchange.

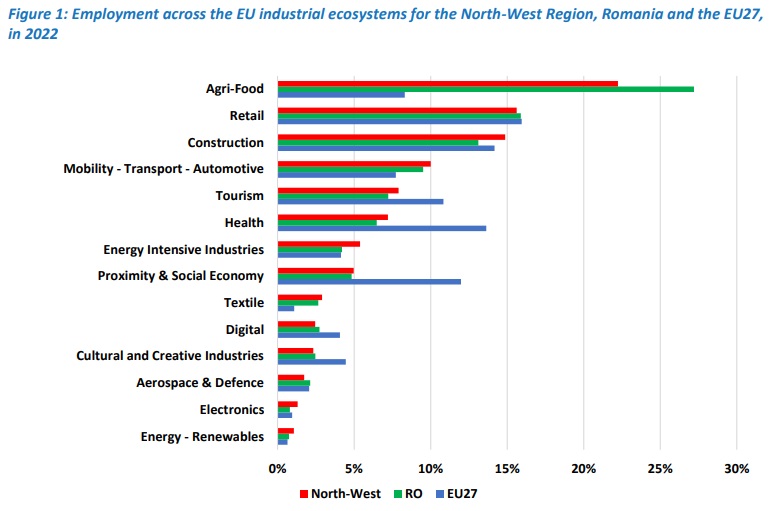

The region’s existing industrial base is complex and the individual counties have different focusses in economic activity. While, for example, Cluj-Napoca has a strong tertiary sector and a less developed primary sector, Satu Mare County's economy is more orientated towards the agricultural sector. Overall the service sector gains significant importance in the regional economic profile, while agriculture continues to play a pivotal role in the rural areas. However, with around 22% of total employment, manufacturing plays a pivotal role in the regional economy. Within this sector, the manufacturing of leather products, of furniture and of textiles remain central industrial focal points[1]. In terms of competitiveness, the production of these goods represents an important comparative advantage for the North-West Region. Although the region ranks low in comparison to other EU-regions (226th out of 234 regions in the Regional Competitivness Index), it is the third most competitive region at national level. Other important sectors with a high share of employment are Construction, Mobility-Transport-Automotive, Energy Intensive Industries, Textile, Electronics, and Energy Renewable.[2]

An additional characteristic of the North-West Region is a high density of SME’s. In 2017 the region counted around 31 SME’s per 1,000 inhabitants which is around EU-average and the second highest density among Romania’s regions. The business support infrastructure of northern Transylvania is well developed. It has 21 industrial parks, which serve to attract foreign direct investment, such as the Cluj Innovation park.

[1] See ECCP Cluster Meet Regions Cluj Input Paper 2025

[2] Ibid

The Nort-West Region faces significant strategic challenges in regional development, particularly in strengthening its innovation capacity and establishing resilient and sustainable pathways toward regional competitiveness. One of the main barriers in achiving these development goals lies in a persistent lack of R&I funding. Low R&I expenditure is not only limited to the North-West Region, but reflects a broader pattern of Romania which ranks as the weakest performing member state of the European Innovation Scoreboard 2023. Public R&I investments remain under 0.0001% of Romania’s GDP[1], contributing to a low level of R&I expenditure in the Nort-West region. The poor funding level is further reinforced by the fact that public sector measures do not adequately adress the needs of the private sector, for example with regards to the development of business infrastructure. Further challenges concern a lack of skilled workers in the service and manufacturing sector and regional imbalances between the counties of the region as Cluj-Napoca exceeds the economic performance of other counties.

Russia’s war against Ukraine affected the regional economy in multiple ways: With its shared border with Ukraine, the region is at the frontline of the geopolitical crises, hosting a large number of displaced persons. Vulnerarbility to energy price fluctuations especially affects the automotive and mechanical engineering industries as well as the construction sector[2]. On the other hand, the war attracted some major investments from companies that relocated their operations from Russia. Most notably, the finnish tire manufacturer Nokian Tyres sold its Russian brand and settled a new production site in Oredia, leading to a total investment of 650 Million Euros.

To address their strategic challenges, the North-West Region defined three pillars of action in its Smart Specialisation Strategy (S3):

- Innovation for health and well-being: this addresses innovation and production priorities in the areas of agri-food, cosmetics and food supplements and health

- Development of emergent, high-tech sectors: this includes innovative materials, methods and technologies as well as necessary infrastructure equipment in the areas of new materials, advanced composites and advances in production technology

Digital Transformation (Regional Digital Agenda): this includes strategic priorities in the area of information and communication technologies

These three pillars represent the cornerstone for the region’s vision to emerge as one of Central Europe’s most innovative regions by 2034 and to promote R&D&I activities aimed at increasing income, occupation and living standards. The strategy defines four strategic objectives that should align and pool ressources towards these areas of specialisation, namely a structural change of the economy, the development of the regional innovation ecosystem, development of research capacity and the use of research data and the use of advantages of digitalisation in the public sector.

[1]European Commission: Commission Staff Working Document – 2024 European Semester: Country Report Romania. SWD(2024) 623 final. Brussels, 19.3.2024. https://economy-finance.ec.europa.eu/document/download/dcac26a0-120e-4233-88b6-8c7b0d919257_en?filename=SWD_2024_623_1_EN_Romania.pdf

[2]European Commission: 2022 European Semester: Country Report – Romania. Brussels, 23.5.2022. https://commission.europa.eu/document/download/cfb7b4a4-eb31-4463-a643-e4d4b3d58efc_en?filename=2022-european-semester-country-report-romania_en.pdf

The woodworking and furniture industry is a well established ecosystem in Romania, drawing on diversified forests with significant production capacities and a long tradition in furniture manufacturing[1]. As a major supplier for the global market leader IKEA, the regional furniture ecosystem is heavily dependent on exports. Aramis Invest, a furniture producer based in the county Maramureș, for example, represents not only Romania’s largest furniture exporter, but also one of the most important employers of the county[2]. The North-West Region, thus, occupies an important position in the global furniture value chain as a manufacturing location, supplier and exporter.

Strengthening their position in the global value chain is a key strategic task for local companies to enhance long-term resilience and economic sovereignty. A stronger focus on the development of their own brands and design activites poses major transformation challenges for the local furniture ecosystem. The North-West Regional Programme, aimed at the 2021-2027 period, refers to this point, with support for internationalisation of SME products and services, including the improvement of marketing solutions. Additionally, the growing pressure to comply with international sustainability requirements, such as circular product design, traceability of raw materials, and carbon footprint reduction, represents another transformation challenge for manufacturers that have traditionally focused on cost-efficiency. Despite the significant challenges posed by the transformation of the furniture ecosystem, the regional actors engage in a variety of promising initiatives, especially through the work of regional clusters.

[1] Ciobanu, Nicoleta-Ruxandra, und Andreea-Roxana Dedu. “An Assessment of Current Employment Needs in the Romanian Furniture Industry.” Academia.edu, 2022. https://www.academia.edu/73465734/An_assessment_of_current_employment_needs_in_the_Romanian_furniture_industry

[2]Vintilă, Daniela, und Irina Zaharia. “Challenges and Perspectives of Youth Employment in Romania – A Regional Analysis.” Journal of Community Positive Practices, Nr. 3 (2023): 3–21. https://www.ceeol.com/search/article-detail?id=1245657

Northern Transylvania stands out for its high-performaning clusters. From a total of 12 ECCP-registered clusters, the region has four clusters that have been awarded the European Cluster Excellence Initative (ECEI) Gold Label for their outstanding achievements in cluster management, innovation and cooperation (Transylvanian Furtniture Cluster, Transylvania IT Cluster, Agro Transylvania Cluster, Transylvania Energy Cluster). In addition to these Gold labels, the region is home to several clusters recognised with Silver and Bronze labels. The cluster organisation of Northern Transylvania can be linked to seven out of the EU’s 14 industrial ecosystems, with three cluster organisations concentrated in the Renawble Energy[1] ecosystem.

The strong presence of high-performaning clusters is even more remarkable considering that this is a relatively young development. As a member of the project Asviloc+ (Agencies Supporting Value of Innovation Systems in Regional and Local Economies), which is a project to enhance the North-West Regional Development Agency (ADR Nord-Vest)’s role in fostering the regional innovation system, the ADR Nord-Vest transferred good practices to the region, beginning in 2012. It thereby actively initatied the creation of some of the regions most active clusters. Since then, the clusters have developed rapidly. The Transylvanian Furniture Cluster, for instance, has reached the Gold-label by the ECEI within just 6 years of activities, as the first cluster of the region. The accelerated formation of clusters emerged not only from regional ambition, but is also driven by the necessity to compete for European funding due to a lack of national funding opportunities.

In 2016 the Transvylanian Furniture Cluster, together with other major regional clusters, consolidated their activities by establishing the Northern Transylvania Clusters Consortium. This consortium engages in joint activities in the areas of regional governance, public entrepreneuship and cluster policies by sharing their infrastructure, human ressources and equipment. By now the cluster consortium encompasses six clusters with about 450-member companies, universities, research entities and public authorities. Since 2022, this previously informal consortium has been formalised as a legal entity under the name SMART TRANSYLVANIA Association.

The ADR Nord-Vest continuously supports the creation and advancement of regional clusters. It does so by initiating projects for cluster excellence management training, cluster management assessments or cluster study visits. Furthermore, the ADR Nord-Vest actively promotes Northwestern clusters at national and European cluster events, and it also promotes cluster projects or regional cluster cooperation models as best practices in relevant contexts. The ADR Nord-Vest is also a host to international cluster conferences, such as the Transylvanian Clusters International Conference. In addition to these efforts, the agency plays an important role in supporting clusters in their ongoing quest for funding, for instance by facilitating access to European funding instrument.

[1] See ECCP Cluster Meet Regions Cluj Input Paper 2025

Transylvanian Furniture Cluster

Recognised with the Gold Label for cluster management excellence, the Transylvanian Furniture Cluster (TFC) combines maturity, strategic focus, and service infrastructure to represent and support the interests of the furniture industry. The cluster brings together triple helix members from across the North-West region. TFC sees its role in fostering economic development by promoting strategic collaboration among stakeholders. As outlined in its mission, the cluster positions itself as a driver of industrial transformation, with a focus on excellence, entrepreneurship, and trust-based cooperation. Its key objective is to establish itself as Romania’s leading industry network along the furniture value chain, contributing to the sector’s sustainable growth through innovation and niche market orientation at regional, national, and international levels.

TFC was established in 2012, emerging as a pilot project under the European territorial cooperation project Asviloc+, coordinated by the ADR Nord-Vest. Bringing together 17 founding companies along with universities, research institutes, and public institutions, the cluster was created to strengthen cooperation across the entire furniture value chain. Following its establishment, the cluster secured dedicated funding through Romania’s Sectoral Operational Programme for Increasing Economic Competitiveness (POSCCE), available from 2012.

Based in Cluj-Napoca and legally represented by Hygia Consult, TFC is an associate structure (NGO) and employs 27 staff members, equivavalent to 7-8 full-time equivalents (FTEs). It comprises 104 members, including producers, research, development, innovation and education organisations, catalysts and support entities. The cluster facilitates a strategic collaboration among its members and external partners. Through this close cooperation, the members create their own integrated value chain based on mutual trust, openness, opportunities and benefits for all involved. The cluster is managed in accordance with its memorandum of association, which mandates the development of an annual activity plan and the implementation of a joint development strategy for its members. The management team ensures ongoing strategic updates, facilitates the evaluation of project proposals in collaboration with members, and oversees the monitoring and measurement of project activities and objectives. The cluster’s budget is reviewed and formally approved each year during the General Meetings.

Building on this collaborative foundation, the cluster’s strategic priorities focus on fostering networks and mechanisms that enable the continuous exchange of ideas, innovations, and know-how across its membership. Many of the cluster’s initiatives focus on joint, resource-intensive projects that are essential for maintaining the competitiveness of Romania’s furniture sector. Funding sources are mainly generated from international funding projects and from providing services within the design, prototyping and testing larboratory, renting out event spaces located in the cluster facilities. The cluster also generates revenues from the annual dues paid by contributing members.

TFC offers a range of services and activities for its members and the region. These services cover training, funding access, infrastructure use, networking, and visibility:

Training & Human Capital Development

- Training and specialisation for employees in the furniture industry value chain

- Participation in programmes, courses, and training for the development of professional competences

Access to Infrastructure & Product Development

- Access to specialised laboratories, the center of excellence for furnite (CEF) and support services for the development and testing of new products

- Access to dedicated cluster programmes and projects

Funding & Operational Support

- Facilitation and attraction of non-reimbursable funds for R&D, new business creation, internationalisation, and investment projects

- Regular provision of reports on relevant topics such as funding calls, public procurement, and specialised events

- Cost reduction through joint negotiations in general-interest procurement

Networking & Exchange of Best Practices

- Opportunities for member interaction and best practice exchange, including “Open House” events

Internationalisation & External Cooperation

- Support in the development of international partnerships, commercial relations, and technology transfer

Policy Advocacy & Representation

- Preparation and support of policy proposals in the interest of cluster members

- Representation of shared industry concerns in discussions with ministries and regional or national authorities

Visibility & Communication

- Access to cluster-organised events

- Use of the cluster’s communication channels and press database

- Increased visibility for active members through promotion via official channels, press releases, or media appearances

One of the main benefits for cluster members is access to design, prototyping and testing laboratories and the Center of Excellence for Furniture (CEF) which is the most ambitious project of the cluster, with laboratories on an area of 4,000m². These facilities support the development of innovative products that meet international quality standards and help companies strengthen their market presence abroad.

With its broad portfolio of activities and its active regional and European engagement, TFC has generated tangible impact on multiple levels. TFC actively contributed to regional strategic documents such as the North-West Smart Specialisation Strategy and engaged in dialogue with regional and national authorities to represent the needs of the furniture industry in its transition towards a creative, sustainable and digitalised economy. It served as an interface between SMEs and public administration, offering concrete feedback on sectoral challenges. By promoting digitalisation, circularity and design, and by stimulating cooperation between companies, universities and research centers, TFC supported industrial transformation and technology transfer.

As a founding member of the Transylvanian Digital Innovation Hub, it contributes to a regional network of 13 organisations that supports SMEs with access to training, funding opportunities and digital matchmaking, particularly in the field of Industry 4.0. TFC has played a key role in several European flagship initiatives:

- In the SILEO Project, TFC supports the digital and circular transformation of SMEs in the furniture and lighting sectors across Europe.

- Within the EXCELIVING and INTRIDE projects, TFC has advanced cross-sectoral cluster cooperation, contributed to innovation transfer, and co-developed a Master’s curriculum aligned with industry needs.

- As part of the Furniture Go International (FGOI) programme, TFC helped establish the GO Furniture Meta-Cluster as a framework for long-term collaboration, opening long-term access to markets in the USA, Canada, Egypt and South Africa.

- The EU4Business Job Shadowing initiative led to direct collaboration with Ukrainian cluster partners and resulted in a follow-up project reaching over 60 entrepreneurs and 240 participants in 2024.

- Through the BETTER FACTORY project, TFC enabled Romanian SMEs to explore automation and industrial design innovation with support from a Europe-wide network.

- In the Girls4Economy project, TFC contributes to shaping the digital and leadership skills of the next generation, particularly girls from underrepresented areas, by supporting education, teacher training and youth-led initiatives.

These efforts in internationalisation through the participation in European projects strengthen the visibility of the region and its ability to attract and utilise European funds and international investments and partnerships. Thus, the Transylvanian Furniture Cluster has positioned itself as a strategic driver for international collaboration and competitiveness in the furniture industry.

Lessons Learned and Transferability

A central insight from the rapid development of the TFC is how international and European competitive pressure can act as a catalyst for cluster excellence. In a context were national funding options were limited, the cluster had to gain independence at an early age and turn to European and international sources of funding instead. TFC thus had to position itself in the European funding landscape from the very beginning and therefore sought out international partnerships and quickly adapted to the highest European quality standards and common European priorities. This structural necessity led to a rapid professionalisation and enhanced visibility. This case highlights how early engagement with international cooperation and competition can accelerate resilience, institutional maturity and long-term positioning within European value chains.

The cluster’s approach to provide high quality infrastructure provides an illustratitve example of how investments in shared facilities can optimise service delivery and strengthen member engagement and visibility. With the elaborated architecture and equipment of the Center of Excellence for Furniture (CEF) TFC offers a space for product design and testing, thus meeting the development needs of SMEs. Furthermore, the CEF provides a space for networking and events, increasing the cluster’s visibility.

Anorther important lessons refers to the cross-sectoral cooperation between different clusters in the North-West Region. Especially the TDIH, described above, serves as an important umbrella organisation for fostering synergies across industries in tackling the cross-cutting challenge of accelerating digital transition. The coordinated, multi-sectoral structure allows for a holistic support system for digital innovation, knowledge-exchange, co-creation and access to funding.

In terms of transferability, other clusters can benefit from adopting a similar approach to international cooperation, leveraging high-quality infrastructure, and introducing cross-sectoral coordination. By building on these practices, clusters in other regions can improve their capacity to support structural change and boost regional competitiveness.

The case of the TFC in the North-West Region of Romania highlights the important role of faciliating policy learning and knowledge transfer among regional policy makers to promote buttom-up approaches for the iniation and consolidation of cluster iniatives. Moreover, the case underlines the advantages of early strategic alignment with European priorities and funding mechanisms to accelerate cluster maturity. International cooperation and access to EU funding act as key drivers for supporting cluster visibility and competitiveness beyond national constraints. The case also shows the importance of investing in shared infrastructure to strengthen service quality, foster innovation capacity and attract international partners.